Our Story

At First 4 Men, it began with a simple yet powerful realization: men lead dynamic and multifaceted lives, yet traditional insurance seemed oblivious to this fact. Driven by a commitment to fill this gap, we embarked on a journey to craft insurance solutions that are as unique as the men we serve.

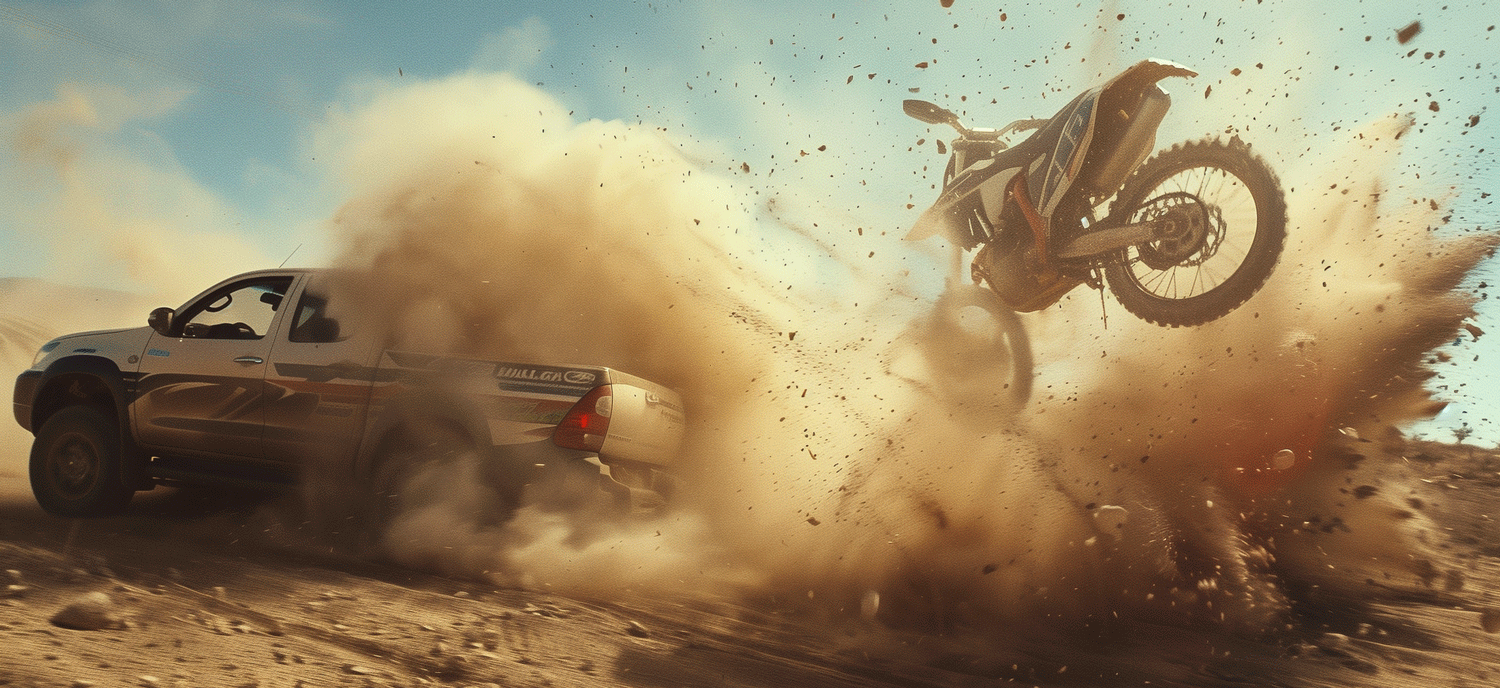

From the thrill-seeker whose weekends are filled with mountain biking through rugged landscapes, to the family man who juggles work and life while planning for the future, First 4 Men stands as a trusted ally. We realized early on that what men needed was not just protection, but a partner who understood the highs and lows of their journeys.

“Relax, man. We’ve got you covered.”

It’s not just our slogan; it’s our promise to you

With First 4 Men, you’re not just buying insurance – you’re joining a community that stands by you, ready to support with solutions that understand and appreciate your unique needs.

Our Promise

We’ve dedicated ourselves to understanding the complexities of men’s lives: Their passions, their possessions and their need for a safety net when things don’t go as planned. This understanding has shaped every product we offer, ensuring that whether it’s a prized sports car, a cherished wristwatch, or the well-being of loved ones, First 4 Men has it covered.

Our team is driven by respect, trust and the unyielding belief that every man deserves insurance that meets him right where he is, in life. We don’t just cover assets; we protect dreams, adventures and the freedom to live life knowing that someone’s truly got your back.

Why Choose Us

Comprehensive Coverage

Our plans offer comprehensive coverage, ensuring you’re protected in every aspect of your life, with a host of excellent extra’s to help along the way.

Real personalised service

Receive personalized service and expert advice from our team of insurance specialists who understand your unique needs and responsibilities.

Super Fast and convenient

Experience hassle-free claims processing with our efficient and responsive claims team, so you can get back to what matters most to you.

First 4 Men FAQ’s

You’re Called “First 4 Men.” Is It Really Only For Men?

Our mission is to offer quality short term insurance built around the needs of South African men, for everything that matters most. This includes cover for family members, who also benefit from our excellent extra’s.

I’ve Never Heard Of First 4 Men Before, Are You New?

First 4 Men may be an overdue and exciting new concept for the South African market, but the parent company and the team involved have been successfully serving the South African insurance industry for over 30 years.

How is First 4 Men doing things differently?

We want to bring personalization and that human connection, back. We’ve ditched the faceless inter-face in favour of real human beings who are a phone call away; looking out for you, to rely on for anything you need, when life happens.

What makes First 4 Men unique?

Instead of expecting men to settle for a generic insurance solution that was never designed with them in mind, we’ve built our offering around what matters most, to men. Our goal is to offer peace of mind and true support when those moments unexpectedly take you from hero to zero.

What does First 4 Men cover?

We cover five categories, custom made for South African men: House (which includes Home Owners and Household Contents), Car (which covers the full spectrum of Motor Vehicle Insurance), Toys (Motorcycles, Watercraft, Trailers and more) as well as Stuff (items that can be either General All Risk or Specified).

In addition, we provide Personal Liability cover, too.

Insurance Is Such A Grudge Purchase. How Is First 4 Men Making It Interesting And Fun?

A man and his life responsibilities are serious enough as it is. We get that. Life’s too short to be serious about everything all the time, so we always try to bring a smile to your face while protecting you with quality cover, that’s got your back.

First 4 Men is not a policy, it’s a lifestyle. When you join us, you are not just another number, you are a part of our tribe.”